change in operating working capital formula

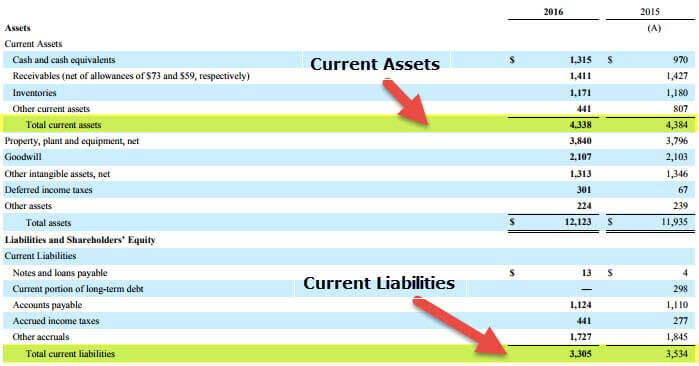

Net Working Capital Current Assets Current Liabilities 49433M 43625M 5808 million. Working capital is calculated simply by subtracting current liabilities from current assets.

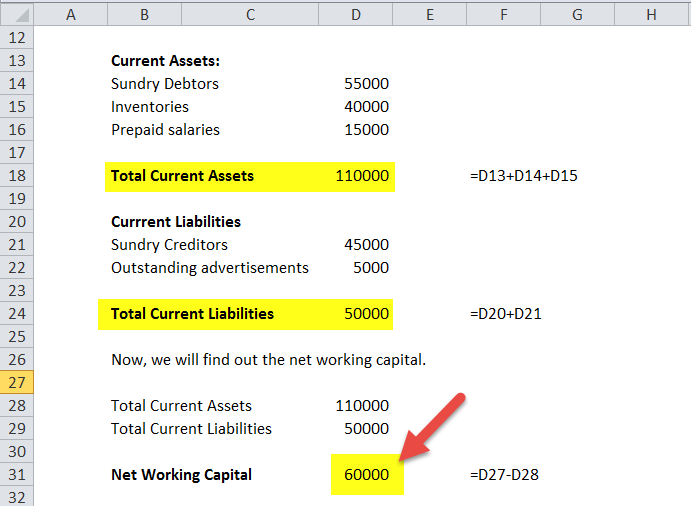

Working Capital Formula And Calculation Exercise Excel Template

The formula is working capital divided by gross sales times 100.

. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or. Working capital refers to a specific subset of balance sheet items. The working capital calculation is given by the following formula.

Net change in Working Capital 1033 850 183. What is Financial Modeling Financial. The definition of working capital shown below is simple.

For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. Net working capital is defined as current assets minus current liabilities. The above definition of working capital is a narrow definition representing the day to day operating working capital required by the business.

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. Change in working capital is a cash flow item that reflects the actual cash used to operate the business. Very often when your business is growing you will need more inventory and operating cash.

Working capital Inventory Accounts receivable Accounts payable. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial. Calculating the metric known as the current ratio can also be useful.

Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. Changes in working capital are reflected in a firms cash flow statement. If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation.

Change in working capital formula fcff. Working Capital Current Assets Current Liabilities. The simple operating cash flow formula is.

For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Changes in Working Capital measures the difference in a companys Net Operating Working Capital between two periods of time.

If a company purchased inventory with cash there would be no change in working capital because inventory and cash are both current assets. If a transaction increases current assets and. Here you can see the value comes out to be negative.

Operating working capital is defined as operating current assets less operating current liabilities. The formula for working capital is current operating assets minus current operating liabilities. Simple Operating Cash Flow Formula.

Changes in working capital equals a change in current assets minus a change in current liabities. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. Here are some examples of how cash and working capital can be impacted.

Calculate The Change In NWC. Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term. You include change in cash as a part of change in overall working capital.

This indicates that the firm is out of funds. Working capital is defined as current assets minus current liabilities. Change in a Net Working Capital Change in Current Assets.

Non-cash working capital 1904 335 - 1067 - 702 470 million. The formula for each company will be different but the basic structure always includes three components. Low working capital and low net operating working capital together with unfavorable current ratio quick ratio days sales in receivable and.

Cancel Reply You must be logged in to post a comment. The last step is to find the change in net working capital. A change in working capital is the difference in the net working capital amount from one accounting period to the next.

The definition assumes cash is a non-operating asset and. A key part of financial modeling involves forecasting the balance sheet. Net Working Capital NWC 75mm 60mm 15mm.

Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. How to Calculate Working Capital.

Operating Working Capital OWC Operating Current Assets Operating Current Liabilities Key Learning Points Working capital is a measure of liquidity and calculated as current assets less current liabilities. Current Operating Assets 50mm AR 25mm Inventory 75mm. Adding to the confusion is that the changes in operating activities and liabilities often called the.

The wrong way to do this is to calculate the working capital in year one from the balance sheet then calculate the working capital in year two from the balance sheet and then subtract to get the change. The net working capital is calculated by simply deducting all current liabilities from all current assets. Net working capital is defined as current assets minus current.

How do you calculate percentage change in working capital. Cash and other financial assets are typically excluded from operating current assets and debt. It still counts as cash that is tied into running the day to day operations of the business.

240000 2022 105000 2021 135000. 1 net income 2 plus non-cash expenses 3 plus the net increase in net working capital. Owner Earnings 8903 14577 5129 13312 2223 13084.

November 13 2021. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Change in a Net Working Capital Change in Current Assets Change in Current Liabilities. Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm.

Cash on hand varies for different companies but having. Thus the value of working capital in 2021 comes out to be -9972000000. Net Operating Working Capital Operating Current Assets Operating Current Liabilities 30678M 34444M -3766 million.

The last step is to determine the change in working capital by using the formula. Net Working Capital Formula. As for the rest of the forecast well be using the.

Changes in working capital -2223. So the change in NWC is 135000.

Change In Net Working Capital Nwc Formula And Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula And Calculation Exercise Excel Template

Working Capital Formula Youtube

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Cycle Efinancemanagement

Cash Flow Formula How To Calculate Cash Flow With Examples

Working Capital Formula And Calculation Exercise Excel Template

Working Capital What It Is And How To Calculate It Efficy

Net Working Capital Definition Formula How To Calculate

Working Capital Cycle Understanding The Working Capital Cycle

Net Working Capital Definition Formula How To Calculate

Changes In Net Working Capital All You Need To Know

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)